When you’re experienced — say, a licensed general contractor — there's a chance you're ready to perform some or the entire get the job done oneself. You can not reimburse your self for labor costs While using the 203(k) loan proceeds, on the other hand.

As you’ve discovered a home to purchase and fix up, you are able to apply for a 203(k) loan with your lender and begin focusing on your own home tasks. The process involves the subsequent methods:

Or your own home renovation could exceed FHA rules due to its luxurious or high cost. You might even choose to handle the function all on your own. Or else you’d favor a renovation loan that doesn’t need property finance loan insurance policy for life.

The loan can also deal with short term housing (if wanted), which can be hire for your period of time that your home is less than rehabilitation.

Right after refinancing, a part of the 203(k) proceeds can pay off your current mortgage loan, and the rest of the income is going to be held within a home finance loan escrow account right until repairs are concluded.

On the other hand, funds can't be used to spend for the labor. Most borrowers desire employing accredited contractors to make sure the work meets FHA guidelines and deadlines.

The house is then appraised to determine its present price and its projected worth right after renovations. Dependant on this, the loan volume is calculated, guaranteeing it falls in just FHA loan boundaries.

As soon as your contractor is on board with supporting you entire your loan application, get Formal bids. Ensure that the bids aren’t guesses.

An FHA 203(k) loan is for home obtain and residential renovation. There's two forms: restricted and common. The quantity borrowed accounts for the two the purchase cost of the home and its renovation costs, which include things like products and labor. It is meant that can help rehabilitate poorer communities and help decrease-income men and women.

Commonly, They are really a bit higher than typical FHA loans due to the additional possibility linked to renovation initiatives.

An FHA 203(k) loan aids homeowners and homebuyers Mix The prices of buying or refinancing a house. In addition it incorporates the bills for necessary repairs or renovations.

Our editorial staff will not acquire direct payment from our advertisers. Editorial Independence Bankrate’s editorial team writes on behalf of YOU – the reader. Our target is to supply you with the very best assistance to assist you make good private finance selections. We follow rigid guidelines making sure that our editorial content material will not be affected by advertisers. Our editorial team receives no direct compensation from advertisers, and here our information is thoroughly reality-checked to be sure precision. So, whether or not you’re looking through an short article or an assessment, you can trust which you’re receiving credible and trustworthy facts.

Like the HomeStyle renovation loan, both of such traditional loan applications Permit you to finance the price of getting and fixing up your private home approximately the maximum conforming loan quantities.

Delaware Licensed Loan Officers

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Danica McKellar Then & Now!

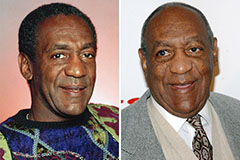

Danica McKellar Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!